Investments

Yazbeck & Co., formerly Yazbeck Investments, was founded in 2008 and has been successful in generating consistent cashflow returns through asset backed investments such as real estate.

In 2013, Yazbeck Investments became an early investor supporting the legalization of the cannabis industry. Some of the early seed investments included MyDx in 2013 at a $5M valuation – a leader in cannabis health technology that went public in 2015 at a $58M valuation; and Ebbu in 2014 at a $3M valuation – a cannabis science and hemp technology company acquired in 2018 for $330 million by Canopy Growth Corporation.

Yazbeck Investments’ market intelligence led to the successful exits from our cannabis portfolio companies by 2022 and after acquiring Laba International Trading Group became Yazbeck & Co. which has diversified its portfolio investments into pharmaceutical and healthcare, agriculture, as well as advanced and sustainable technology companies.

Active Investments

Antharis Therapeutics

Antharis Therapeutics in 2022 – a biopharmaceutical company developing a leading portfolio of cancer and neurology related immunotherapeutics. Yazbeck Investments helped Antharis secure $43M to restructure the company and complete its Series A round which placed the company at the leading edge of biotechnology companies generating high-potential biologic assets for the treatment of significant diseases in multiple therapeutic classes.

Tillat Pharmaceuticals

Tillat Pharmaceutical in 2023 – a company that manufactures and commercializes high demand, halal-compliant generic medications to an array of countries worldwide. Currently, Tillat has a pipeline of 16 halal medicines (8 biotherapeutic and 8 small molecule) at various stages of development. The company expects a majority of these medications to be available to consumers globally by 2026.

Living Fresh Produce

Living Fresh Produce in 2024 – a technology driven agriculture company creating 40-foot Living Fresh Produce Container Farms that can Grow 5 Acres of Food with 97% Less Water. The first farm was launched in Hawaii to help address community shortage issues of produce.

Exited Cannabis Investments

MyDx

MyDx in 2013 – a leader in cannabis health technology tracking the science of how cannabis makes people feel. Mr. Yazbeck founded, seeded the capital for, took the company public, and successfully developed the product and created a market for the first handheld chemical analyzer for cannabis consumers

EBBU

Ebbu in 2014 – Yazbeck Investments was one of the first investors in Ebbu, a leader in hemp research acquired in 2018 for $330 million by Canopy Growth Corporation.

Ramona Cannabis Company

Ramona Cannabis Company in 2020 – a San Diego county licensed and vertically integrated cannabis company currently operating a profitable retail dispensary and delivery service, a manufacturing and co-packing facility, a distribution hub, and is licensed for cannabis cultivation.

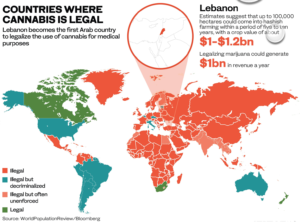

Global Cannabis Legalization Efforts

Since 2018, Mr. Yazbeck has been working closely with local Lebanese scientists, business leaders, activists and government regulators to help draft and pass a law to Legalize Cannabis in Lebanon. On April 21, 2020, Lebanon passed legislation legalizing medical cannabis cultivation in the country.